Exness Saudi Arabia

Exness has been operating since 2008 and has earned a reputation for excellent service, fast execution, and transparent terms. Exness is committed to social responsibility and supports various initiatives and charities around the world.

If you are looking for a reliable and regulated forex broker in Saudi Arabia, Exness may be a good choice for you. Exness serves traders in Saudi Arabia through its entities in Seychelles, Curaçao, British Virgin Islands and South Africa, which are supervised and regulated by reputable regulators. Exness also provides interest-free Islamic trading accounts, Arabic language support, and convenient payment methods for Saudi traders.

Licensing and Regulation of Exness in Saudi Arabia

Exness is a global Forex broker operating internationally through regulated subsidiaries. Although Exness does not have a Saudi trading licence, Saudi nationals can use its services through properly licensed and regulated entities including:

- Exness (SC) LTD: Authorised in Seychelles by the Financial Services Authority (FSA) with licence SD0251.

- Exness B.V: Licensed in Curaçao by the Central Bank, under licence 0003LSI2.

- Exness (VG) Ltd: Licensed in the British Virgin Islands by the Financial Services Commission, under licence SIBA/L/20/11333.

- Exness ZA (PTY) Ltd: Licensed in South Africa as a Financial Service Provider by the FSCA, under licence number FSP 51024.

These Exness-affiliated entities adhere to strict standards from prestigious regulators regarding security, segregation of funds and fairness in trading. By adhering to local laws abroad, Exness seeks global legitimacy despite not being directly regulated in Saudi Arabia. Saudi traders can access its services through properly authorised international branches to take advantage of Exness’ cutting-edge platforms and tools.

Does Exness have Authorisation to Operate in Saudi Arabia?

As there are no specific forex regulations in Saudi Arabia, foreign brokers such as Exness can offer their services to Saudi traders without local authorisation. Exness provides access through properly licensed offshore affiliates in Seychelles, Curaçao, British Virgin Islands and South Africa, regulated by trusted authorities. Trusted for over a decade, Exness accommodates Saudi clients with Arabic and Islamic interest-free accounts while respecting local cultural customs despite its lack of physical presence. By following the rules of offshore regulators, Exness can continue to offer innovative trading platforms and access to global markets legally for Saudi residents wishing to trade forex online.

Exness, an international brokerage firm, is expanding its presence in several countries. Here you can learn about:

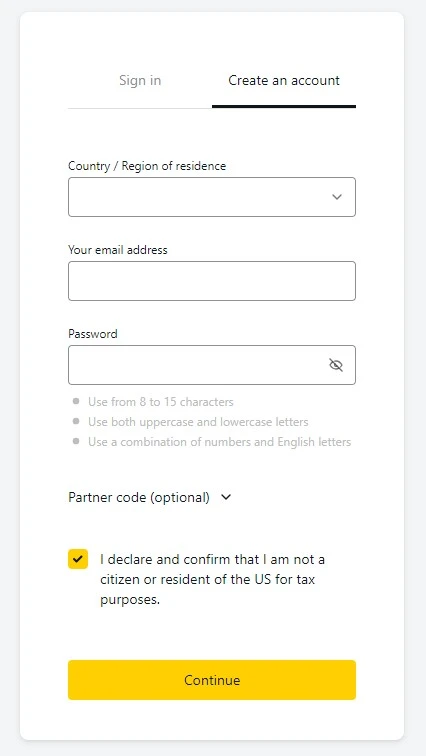

Account Registration And Verification Process

Opening an Exness account in Saudi Arabia is a simple and quick process that can be done online in a few minutes. You will need to provide some basic personal information, choose your account type and currency, and agree to the terms and conditions. You will also need to verify your identity and address on Exness by uploadingsome documents, a mandatory step to ensure your security and compliance. Here are the details of the account registration and verification process:

Open Exness Account in Saudi Arabia

To open an Exness account in Saudi Arabia, you need to follow these steps:

- Visit the Exness website and click on the ‘Register’ button in the top right corner.

- Enter your email address and create a strong password. You can also register using your Google or Facebook account.

- Choose your country of residence, account type, and account currency. You can choose from Standard Accounts, Professional Accounts, Raw Spread Accounts, Zero Spread Accounts, USD, EUR, GBP, SAR, and other currencies.

- Read and accept the Client Agreement, Privacy Policy and Risk Disclosure Statement. You can also sign up to receive marketing communications and news from Exness.

- Click the ‘Create Account’ button and check your email for a confirmation link. Click on the link to activate your account.

Documentation Requirements for Residents of Saudi Arabia

To verify your identity and address, you need to upload certain documents to your Exness Personal Area. This is a necessary step to comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, and to protect your account from unauthorised access and fraud.

The documents you need to upload are:

- Proof of Identity (POI) document, such as passport, national ID card, or driver’s licence. The document must be valid, clear, and show your full name, date of birth, photo, signature, and expiry date.

- Proof of Address (POA) document, such as a bank statement, utility bill, or tax bill. The document must be issued within the last 6 months, show your full name and address, and match the address you provided during registration.

You can upload your documents in the ‘Verification’ section of your Personal Area, or using the Exness Trader app on your mobile device. The verification process usually takes up to 24 hours, but may take longer in some cases. You will receive an email notification when verification is complete. You can also check the verification status in your Personal Area.

Best Exness Trading Account Type for Saudi Traders

Exness offers five different types of trading accounts, each with its own features and benefits. Depending on your trading style, experience, and preferences, you can choose the best account type for you. Here is a brief overview of each account type:

Standard Account:

This account type requires no Exness minimum deposit, features stable spreads, no commissions, and over 120 trading instruments. It is suitable for new and experienced traders alike.

Standard Account Cent:

This account type allows trading in cent units, which means a smaller trading volume and less risk. It is ideal for beginners who want to practise and test their strategies.

Professional Account:

This account type requires a minimum deposit of $200 and features tight spreads, no commissions, and market execution. It is designed for professional traders who want to trade with high leverage and fast execution.

Spread Account:

This account type requires a minimum deposit of $200 and features raw spreads from 0 pips, low commissions, and market execution. It is ideal for traders who want to trade with low costs and maximum efficiency.

Zero Account:

This account type requires a minimum deposit of $200, features zero spreads, low commissions, and instant execution. It is ideal for traders who want to trade with no slippage and no re-quotes.

Exness Islamic Swap-Free Trading Account

Exness honours Islamic principles and values and offers Islamic accounts for swap-free trading. Swap-free accounts are automatically applied to traders residing in Islamic countries and are also available to traders residing in non-Islamic countries under certain conditions. Swap-free accounts do not charge any interest or swap fees on trades held overnight, in accordance with Islamic law.

Exness offers two types of Islamic swap accounts: Standard and Extended. The Standard account is swap-free for cryptocurrencies only, while the Extended account is swap-free for major and minor currency pairs, metals, all cryptocurrencies, stocks, and indices. The swap-free account level is determined based on the trader’s activity and behaviour. To maintain the swap-free status of the Expanded Swap Free Account, it is preferable to trade mainly during the day and minimise positions held overnight.

Exness Islamic accounts have the same features and benefits as regular accounts, such as no minimum deposit, no commissions, high leverage, and a variety of trading instruments. Exness Islamic accounts are also compatible with all trading platforms, such as MetaTrader 4, MetaTrader 5, WebTerminal, and Exness Terminal. Exness Islamic accounts are a great option for traders who want to trade in a halal and ethical manner.

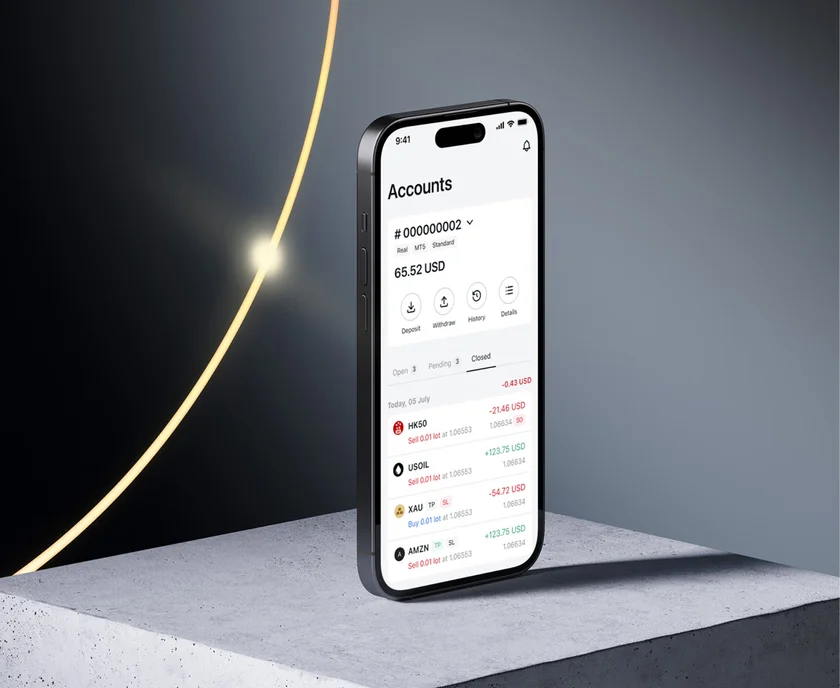

Exness Arabia Trading Platforms

Exness offers a variety of trading platforms to suit the needs and preferences of different traders. You can choose from the industry’s most recognised and advanced platforms, such as MetaTrader 4, MetaTrader 5 and Exness Terminal, or use WebTerminal or the Exness Trader app for flexible and convenient trading on any device.

Availability of MT4, MT5 and Exness trading platforms

- Exness MetaTrader 4 (MT4) and Exness MetaTrader 5 (MT5) are the leading platforms in the forex market, offering a user-friendly interface, a wide range of technical analysis tools, automated trading systems, market news and signals. You can download and install MT4 and MT5 on your computer, or use the web version on your internet browser. You can also trade on the go using the MT4 and MT5 apps for Android and iOS smartphones.

- Exness Terminal is a proprietary trading platform developed by Exness, which combines the best features of MT4 and MT5, as well as some unique and innovative functionalities. You can access Exness Terminal via your web browser, or download the desktop version for Windows or Mac.

- Exness WebTerminal is an online trading platform that allows you to trade directly from your web browser, without having to download or install any software. You can use WebTerminal with any Exness account type and any trading instrument.

- Exness Trader is a mobile trading app that allows you to trade anytime, anywhere, with just a few taps on your smartphone or tablet. Exness Trader is available for Android and iOS devices.

Depositing and Withdrawing from Exness Accounts in Saudi Arabia

Exness offers several secure funding methods for traders in Saudi Arabia. Convenient options include credit/debit cards, bank money transfers, e-wallets such as Neteller and Skrill, and even cash Exness deposits through payment systems such as Metatrader Debit Card and UnionPay. Traders can easily deposit funds in USD and over 15 other currencies. Withdrawals can be quickly processed and returned to the original payment method. Currently, Exness does not support direct transfers in Saudi Riyals, but the transfer channels help facilitate funding flexibility.

Exness Trading Conditions and Offers

Exness offers optimal trading conditions for Saudi investors looking to access the Forex and CFD market, with tight spreads starting from 0 pips, fast execution speeds under 30ms, and leverage up to 1:2000. Traders can experience diverse global markets while benefiting from an award-winning proprietary platform.

Commissions, fees, spreads and leverage rates

There are no commissions or fees applicable to trading major forex pairs with Exness along with low and competitive spreads averaging 0.1 on EUR/USD. Spreads start at 0 pips with commissions charged on CFDs on stocks and cryptocurrencies. Swaps are exempt with Islamic accounts. All account types can access maximum leverage of up to 1:2000, the highest level among margin brokers.

Markets and Assets Available to Saudi traders

Exness gives Saudi traders access to over 50 currency pairs and CFDs on commodities, cryptocurrencies, stocks, indices and ETFs. This provides ample opportunity for portfolio diversification with assets covering global markets and optimal trading flexibility across multiple platforms.

Exness Customer Support in Saudi Arabia

Exness provides dedicated Arabic support that is accessible 24 hours a day, 7 days a week via multiple channels including live chat, email, phone, and an online contact form. A Saudi office offers localised assistance and seminars as well as a team of Islamic account managers who are fluent in Arabic.

Arabic Language Support

Exness customer service staff offer full Arabic language support through online chat, email, and telephone contact. Arabic is also available across the web and app platforms.

Advantages and Disadvantages of Choosing Exness in Saudi Arabia

Advantages:

- Regulation with top-tier recognisers abroad.

- Spreads as low as 0 pips.

- Leverage up to 1:2000.

- Award-winning proprietary platform.

- Access to global markets with 50+ assets.

- Arabic language support and Islamic accounts.

Disadvantages:

- No specific Saudi trading licence.

- No direct Saudi Arabian Riyal (SAR) for transactions.

Is Exness Recommended for Saudi traders?

With licences from top-tier regulators such as CySEC and advanced customised trading platforms that combine robust performance and accessibility, Exness is a leading choice for Saudi traders. Exness has over a decade of experience serving clients in the GCC region with localised offices and culturally fluent multilingual support teams.

For Saudis looking for optimal conditions such as ultra-low spreads, high leverage levels, fast trade execution, access to diverse global markets alongside popular MetaTrader suites and innovative proprietary platforms enhanced by user-friendly mobile apps, Exness offers a flexible solution. With multiple account offerings ranging from small lots to major VIP client services, Saudi investors can access global support, trade execution, and analytical tools through Exness as a premium market leader in the competitive forex brokerage space.

Trade with Exness – Trusted by Over 800,000 Traders

Discover why Exness is the broker of choice for over 800,000 traders and 64,000 partners. Start trading with a reliable, secure platform today.

Frequently Asked Questions

Does Exness Arabia offer Arabic support and customer service?

Yes, Exness provides 24/7 Arabic customer support via channels such as phone, email, and live chat.

What documents do you need to open an Exness trading account as a resident of Saudi Arabia?

Only a valid passport or national ID is required to open an Exness account.

Can I trade popular assets such as forex, cryptocurrencies, stocks, indices and commodities with Exness in Saudi Arabia?

Yes, Exness gives Saudi traders access to over 50 assets, including currency pairs, cryptocurrencies, stocks, indices and commodities.

Can I easily fund my Exness account and withdraw profits from Saudi Arabia?

Yes, Exness offers several secure funding and withdrawal options for traders residing in Saudi Arabia.