Overview of Exness Presence in Libya

Exness, a renowned global forex broker, has established a tangible presence in Libya by skilfully adapting its services to the unique needs of Libyan traders. Aware of the specifics of the local market, Exness has focused on aligning its offerings with the requirements and preferences of traders in this region.

Key to their success was adapting to local financial regulations, ensuring full compliance and gaining the trust of Libyan merchants. Exness has also emphasised providing culturally relevant services, understanding the importance of engaging with local customs and traditions. A large part of their strategy includes making their trading platforms accessible and easy to use for the Libyan audience. This includes intuitive navigation, local language support, and integrating tools and features that cater to the specific trading styles and strategies favoured in Libya. These dedicated efforts from Exness demonstrate a strong commitment to providing a personalised and supportive trading environment for their clients in Libya.

Regulation and Licences

As a global trading platform, Exness is committed to adhering to the highest standards of regulation, ensuring a safe and transparent trading environment. The company is regulated by several respected international bodies, emphasising dedication to financial integrity and operational transparency. Below is a brief overview of Exness’ regulatory compliance in various jurisdictions:

- Seychelles Financial Services Authority (FSA): Licence number SD025 for Exness (SC) Ltd.

- Central Bank of Curaçao and Sint Maarten (CBCS): Licence number 0003LSI for Exness B.V.

- Financial Services Authority, British Virgin Islands: Licence number SIBA/L/20/1133 for Exness (VG) Ltd.

- Financial Services Authority, Mauritius: Licence number GB20025294 for Exness (MU) Ltd.

- Financial Sector Conduct Authority, South Africa: FSP 51024 for Exness ZA (PTY) Ltd.

- Cyprus Securities and Exchange Commission (CySEC): Licence number 178/12 for Exness (Cy) Ltd.

- Financial Conduct Authority, United Kingdom: Registration number 730729 for Exness (UK) Ltd.

- Capital Markets Authority, Kenya: Licence number 162 for Tadinix Ltd.

This extensive regulatory framework reflects Exness’ commitment to providing a reliable trading platform that is in line with international standards and local legislation, including that of Libya. Diverse licences ensure that Exness is able to serve a wide range of traders with diverse needs while maintaining high standards of safety and reliability.

Exness, an international brokerage firm, is expanding its presence in several countries. Here you can learn about:

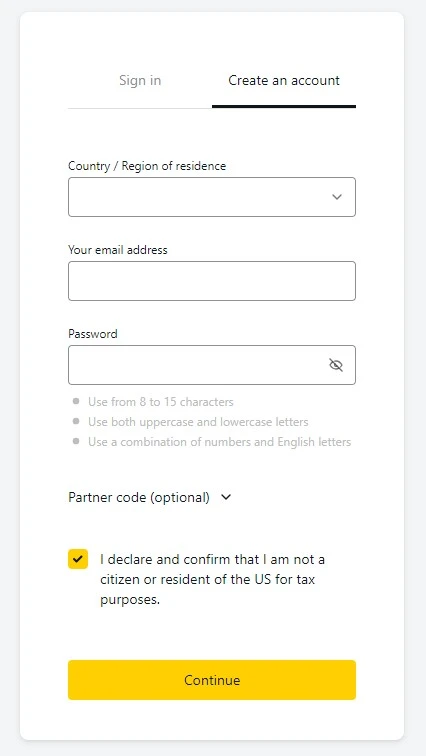

Enrolment in Exness in Libya

For Libyan merchants looking to register with Exness, the process is efficient and easy to use. Below is a breakdown of the key steps involved:

- Visit the Exness website: Go to the Exness website and click on the Register or Subscribe option.

- Enter personal information: Fill in the registration form with your name, email and phone number, ensuring accuracy and matching documents.

- Create a password: Select a strong password that combines letters, numbers and special symbols.

- Verify identity: Upload a clear copy of your government-issued ID (passport or national ID card), ensuring validity and clarity.

- Proof of residency: Provide a recent document (last 3-6 months) such as a utility bill or bank statement showing your name and address.

- KYC and AML compliance: Complete KYC and AML checks by providing the necessary documentation.

- Wait for verification: Wait for Exness to verify your account, which may vary in time based on the volume of requests.

- Receive a confirmation email: Look forward to an email from Exness confirming your account verification with additional details.

- Account Login: Log in to Exness using your registered email address and the new password you created.

- Setting up your trading profile: Complete your trading profile with information about your trading experience and financial situation.

- Fund the account: Deposit funds using available methods, subject to any minimum requirements or fees.

By following these steps, Libyan traders can ensure a smooth and secure registration process with Exness, setting the stage for a reliable trading experience.

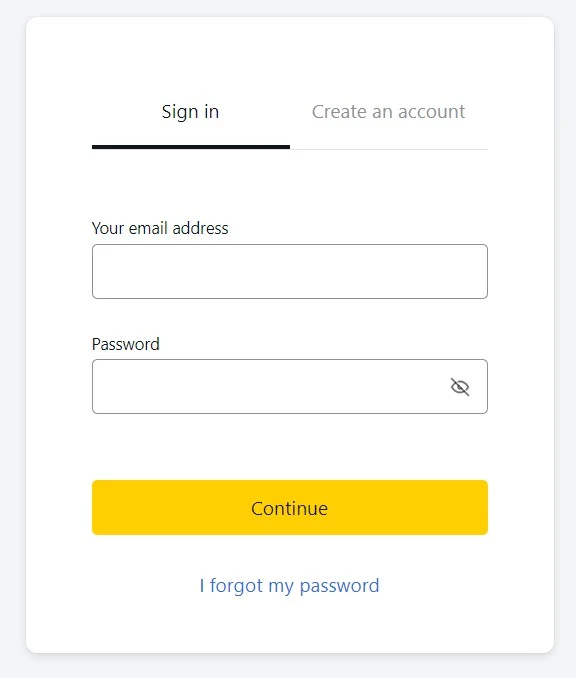

Exness Login for Libyan traders

Exness provides a streamlined and secure login process for traders, ensuring easy access to its trading platforms. This user-friendly approach is designed to deliver a hassle-free experience while maintaining high security standards. Here’s a quick look at the Exness Login process:

- Access the Exness website or app: Merchants can start by visiting the website or opening the mobile app.

- Entering login credentials: Users need to enter their registered email address and password.

- Two-Step Authentication (optional): To enhance security, Exness may offer an optional two-factor authentication feature.

- Direct access to the trading panel: Once logged in, traders are taken directly to the trading panel where they can view their portfolio, access markets, and execute trades.

- Support for forgotten data: If passwords are forgotten, there is an easy data reset process, ensuring continuous access.

These effective login procedures emphasise the dedication Exness shows in combining user convenience with strong security measures.

Deposits and Withdrawals at Exness in Libya

For merchants in Libya, Exness offers a range of deposit and withdrawal options, designed to match local banking and financial systems. This variety of financial transaction methods not only provides convenience, but also caters to the diverse preferences and needs of merchants. Below is a list of methods available for both deposits and withdrawals at Exness in Libya, recognised for their efficiency and speed of processing:

- Bank transfers: Use local and international bank transfer options for both deposits and withdrawals.

- Credit/Debit Cards: Use major credit and debit cards for transactions, including Visa and MasterCard.

- E-wallets: Utilise various e-wallet services, which may include options such as Skrill, Neteller, WebMoney, etc.

- Cryptocurrencies: Use various cryptocurrencies for deposits and withdrawals, offering secure and modern digital transfer options.

تم تصميم كل من هذه الطرق لتتناسب مع أنظمة البنوك والممارسات المالية في ليبيا، مما يضمن الوصول والراحة للتجار الليبيين. بالإضافة إلى ذلك، تشتهر Exness بسرعة معالجتها لعمليات السحب، وهو ميزة حاسمة لأولئك الذين يحتاجون إلى الوصول السريع إلى أموالهم.

Exness Trading Services and Platforms

Exness offers a wide range of trading services and platforms, catering to the needs of both novice and professional traders in Libya. The broker provides access to a wide range of financial instruments, including forex currency pairs, metals, cryptocurrencies, energy, and indices. Exness’ trading platforms are powerful and easy to use, with popular options such as MetaTrader 4 and MetaTrader 5 available. These platforms are renowned for their advanced charting tools, algorithmic trading capabilities, and customisable features, making them suitable for various trading strategies.

Ready to get started?

Exness Account Types

Exness recognises the diverse needs and preferences of traders in Libya and offers a comprehensive range of account types to suit different trading styles and experience levels. From beginners to seasoned professionals, there is an Exness account type tailored to meet the specific requirements of each trader.

Exness Demo Account

For beginners in Libya, the Exness Demo Account is an excellent starting point. It allows traders to practice trading in a risk-free environment using virtual funds. This account is particularly useful for understanding market dynamics and getting used to the trading platforms offered by Exness without any financial risk.

Exness Islamic Account

Recognising the religious practices in Libya, Exness offers an Islamic account that complies with Sharia law. This type of account does not include any swap or deferral interest for positions held overnight, a critical consideration for Muslim traders.

Exness Standard Accounts

Exness Standard Accounts are designed for general traders, while offering a balance of features suitable for most traders. This includes competitive spreads, moderate leverage options, and minimal initial deposit requirements. These accounts are ideal for traders looking for a straightforward trading experience.

Exness Professional Accounts

For more experienced traders in Libya, Exness Professional Accounts offer more advanced features. These accounts typically offer narrower spreads, higher leverage options, and prioritised customer support. They are well-suited for professional traders who require advanced trading tools and resources.

Exness ECN Account

The Exness ECN account is designed for traders who prefer direct access to the currency markets. This account type offers lower spreads as it gives traders direct access to the bank market. It is particularly favoured by high-volume traders who follow scalping strategies.

Exness Trading Platforms in Libya

Exness offers a variety of trading platforms to cater to the diverse needs of traders in Libya. From mobile trading to advanced desktop solutions, Exness ensures that every trader has access to the tools and functionality needed for an efficient trading experience. Here is a detailed look at the available platforms.

- Exness Trade App

- Exness MT4

- Exness MT5

- MT Web Terminal

Exness Mobile App

The Exness mobile app is a vital tool for traders in Libya who need to trade on the go. With its user-friendly interface, the app offers comprehensive functionality including real-time quotes, advanced charting tools and efficient trading and account management capabilities. It is designed to fulfil the modern trader’s need for fast and accessible trading solutions, enabling market participation anytime, anywhere.

Exness MT4

MetaTrader 4, offered by Exness, is highly favoured by Libyan traders due to its reliability and wide range of features. Known for its advanced charting options, Exness MT4 also supports automated trading using Expert Advisors (EAs), while providing a range of technical indicators and tools. Its intuitive interface appeals to both beginners and experienced traders, making it a versatile choice for various trading strategies.

Exness MT5

MetaTrader 5 is an enhanced version of MT4 and comes with additional benefits. Exness MT5 includes more timeframes, more indicators, and an integrated economic calendar, all of which contribute to a more comprehensive trading experience. The platform’s enhanced order execution feature makes Exness MT5 an excellent choice for Libyan traders looking for more advanced tools and functionality for their trading activities.

Exness Web Terminal

In addition to mobile and desktop platforms, Exness also offers a web terminal for traders who prefer to trade via a web browser. The Exness Web Terminal, which can be accessed directly via a web browser without any download, mirrors the functionality of the MT4 and MT5 platforms. It provides a convenient and flexible trading solution, especially for those who need quick access to the market without the hassle of installing software. This platform is equipped with essential trading tools and real-time data and has been automated for performance and efficiency.

Advantages of Trading with Exness in Libya

Exness offers many benefits to traders in Libya, enhancing their trading experience. Here are the main benefits outlined in a brief list:

- Diversified financial instruments: Access to a wide range of financial instruments, suitable for different trading interests and strategies.

- Competitive spreads: Benefit from tight spreads that maximise trading efficiency and potential profitability.

- Flexible leverage options: Customise your trading approach with a range of leverage options to suit different risk tolerance levels.

- A range of account types: Choose from several account types, each designed to accommodate different trading styles and experience levels.

- Regulatory compliance and transparency: Trade with confidence in a secure environment backed by Exness’ adherence to strict regulatory standards and transparent practices.

These features make Exness an attractive and convenient choice for traders in Libya, offering a balance of flexibility, security and opportunity.

Exness Customer Support

Exness is characterised by exceptional customer support, a vital aspect of their services that greatly benefits traders in Libya. The support system is designed to be accessible, responsive, and highly professional, to meet the needs of a diverse trading community.

Contact Information

Traders in Libya can access Exness customer support through a range of channels. These include these:

- Email: For detailed enquiries and official communication.

- Live chat: Immediate support for quick enquiries and issue resolution.

- Phone support: A direct line for more personalised assistance.

The Exness support team is well-trained to handle a wide range of issues, ensuring that traders receive the necessary guidance and solutions quickly.

Language Support

Understanding the diversity of languages in Libya, Exness has ensured that customer support is available in multiple languages, including Arabic. This is particularly beneficial for Libyan traders, as it facilitates effective communication and support in their native language. Having access to support in Arabic and other languages is a sign of Exness’ commitment to providing an inclusive and accessible trading experience. This multilingual support not only enhances understanding, but also ensures that traders from diverse linguistic backgrounds in Libya can interact more comfortably and confidently with the platform.

Exness Education Resources

Exness demonstrates a strong commitment towards educating its clients, offering a wide range of educational resources specifically designed for traders in Libya. These resources are designed to enhance the trading knowledge and skills of both beginners and experienced traders, ensuring they have the tools to succeed in the dynamic world of trading.

Basic Trading Lessons: Ideal for beginners, these lessons provide a solid foundation in trading principles, helping new traders understand market dynamics.

Advanced Strategy Guides: For experienced traders, these guides cover advanced trading strategies and techniques, perfect for refining their trading approach.

Webinars: Conducted by experienced professionals, these interactive sessions offer valuable insights into market trends, analysis and trading strategies.

Alongside these resources, the Exness Help Centre offers comprehensive support and information on various trading topics. These resources are continuously updated to stay current with market trends. These resources, along with the Help Centre, equip Libyan traders with essential information and tools, demonstrating Exness’ commitment to empowering them through education and tailored support.

Merchant Reviews about Exness

Exness has become very popular in Libya thanks to its powerful trading platform, diverse account options and outstanding customer service. The tailor-made approach to meeting the needs of Libyan traders is evident. Below are some representative reviews from local traders, highlighting the real impact Exness has had on their trading experiences.

Ahmed Zawi:

‘I have been trading with Exness for over a year now, and the reliability of their platform is unrivalled. The speed and efficiency has greatly enhanced my trading experience. Also, their customer service team always has a quick and helpful response, which is crucial for me.’

Fatima Saleh:

‘As a beginner trader, I found the education resources at Exness extremely helpful. Their lessons and webinars made me able to understand the basics and gradually shift to more complex trading strategies. It’s great to have such support at your fingertips.’

Mustafa Al-Jarrah:

‘The variety of account options at Exness allowed me to find the perfect fit for my trading style. I started with a standard account and moved to a professional account as I gained more experience. The transition was seamless, and each account type offered its own unique benefits.’

Conclusion

Exness has become a key figure in Libya’s trading market, recognised for its diverse and user-friendly platforms such as a mobile app, MT4 and MT5, and a range of financial instruments and accounts. Its focus on technological innovation, customer support and learning resources, including multilingual options such as Arabic, has resulted in positive feedback from the Libyan trading community, cementing its reputation as a trusted and supportive forex broker in the region.

Ready to get started?

It only takes 3 minutes to set up your account and get it ready to trade

Frequently asked questions: Exness Libya

Are there any special deals for Exness clients in Libya?

Yes, Exness offers a range of promotions for Libya clients, including deposit bonuses, low spreads, and trading contests. It is recommended to regularly check their website or contact support for the latest offers.

Can Exness interfaces be customised?

Absolutely. Exness platforms, especially MT4 and MT5, allow for extensive customisation, including layout adjustment, chart type selection, and various technical indicators for a personalised trading experience.

What risk management tools does Exness offer in Libya?

Exness offers tools such as stop loss and take profit orders, trailing orders, and limit orders. They also ensure negative balance protection to prevent clients from losing more than their deposits.

Is there a trading community for Exness users in Libya?

While there is no specific community for Libya, Exness offers global forums for traders to interact, share strategies and learn, which can be accessed via their website.

How often does Exness update its educational resources?

Exness continuously updates educational resources, including webinars, tutorials and market analyses, to reflect the latest market trends and information.

Are there withdrawal restrictions for Exness customers in Libya?

Exness offers flexible withdrawal options in Libya, although availability and limits may vary based on local financial regulations. Traders should check the Exness website or contact customer service for current details.