Exness Oman

One of the biggest global forex brokers Exness has made its foray into Oman, to provide Omani traders with various trading instruments and platforms. Exness commits to the provision of excellent trading conditions and is known for being transparent, reliable, offers services specific to Omani traders.

Understanding Exness in the Omani Market

The broker has made considerable progress in capturing the Omani market and is now a reputable name known for its easy-to-navigate platforms, low spreads, and great customer service. Omani traders will have access to a range of services that are meant to improve their trading experience, such as flexible account options and several trading instruments.

- Understanding Exness in the Omani Market

- Is Exness Regulated in Oman?

- Exness Account Options for Omani Traders

- Exness Trading Platforms Available in Oman

- How to Open an Exness Account in Oman

- Funding Your Exness Account in Oman

- Withdrawing Funds from Exness in Oman

- Available Trading Instruments

- Educational Resources for Omani Traders

- Advantages of Trading with Exness in Oman

- Frequently Asked Questions about Exness Oman

Is Exness Regulated in Oman?

Although Exness is not licensed directly in Oman, it falls under numerous international licenses that allow the broker to be compliant with global financial standards. The Financial Services Authority (FSA) in Seychelles, the Cyprus Securities and Exchange Commission (CySEC), as well as other relevant regulators have licensed Exness to operate. It gives the traders of Oman a lot of confidence to trade with Exness because they are following high-level regulations.

Exness Account Options for Omani Traders

Exness has multiple account types to cater for traders in Oman, new and experienced. For a basic account without minimum deposit, or an advance accout type with the tightest spreads there is likely to be something that’s suitable for you at Exness.

Standard vs Professional Accounts

Omani traders get Standard and Professional accounts. As a novice, you can go for the Standard Account which has no minimum deposit and tight spreads. Professional accounts, such as the Pro, Raw Spread and Zero account types on offer here are for more seasoned traders looking to trade with tighter spreads along with higher leverage options.

Islamic Trading Accounts

Being a Shariah-compliant nation, Exness provides Islamic trading accounts in Oman. These accounts are really offered free of swaps which mean no overnight interest charges making them fully compatible with Islamic finance principles.

Exness Trading Platforms Available in Oman

Exness offers Omani traders access to some of the top trading platforms in use today. It does not matter if you want to trade via your desktop or in the web Interface of Exness trading platform as well on your mobile.

MetaTrader 4 and 5 for Omani Traders

Exness provides traders in Oman with MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are the most commonly used trading platforms across all types. Their user-friendly interface and expert charting tools make them the top choice for anyone looking to set up an automated trading ecosystem via Expert Advisors.

Exness Web Terminal

Exness Web Terminal great for traders who do not want to download software. The browser-based platform provides a trading tools and features, enabling traders with Oman to execute from any location with internet access.

Exness Mobile Trading App

Mobile trading app from exness gives a Omani trader complete freedom to manage there account andtheir trades on the go. Real-time trading available through a cutting-edge streamlined app that is compatible with both iOS and Android devices making it perfect for many active traders.

How to Open an Exness Account in Oman

Opening an account with Exness in Oman is a straightforward process designed to get you trading quickly and efficiently. Here’s a step-by-step guide to help you get started.

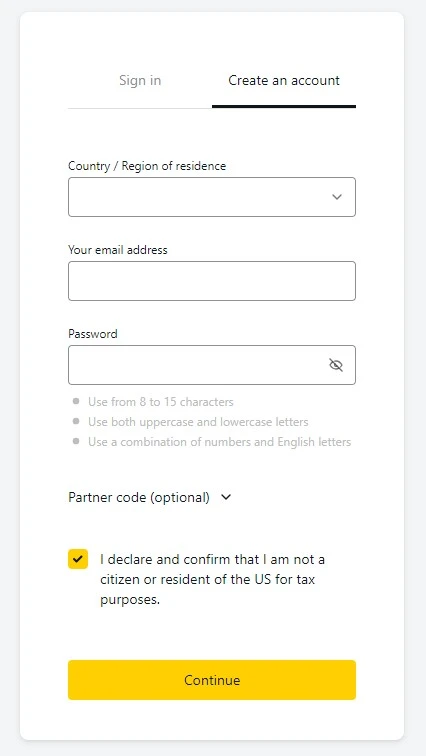

Registration Process

To open an account, Omani traders need to visit the Exness website, select their preferred account type, and complete the online registration form.

Step 1: Visit the Exness Website

Go to the Exness website on your computer or phone.

Step 2: Click “Open Account”

On the homepage, click the “Open Account” button to start.

Step 3: Fill in Your Details

You’ll see a form where you need to enter:

- Email Address: Use an email you regularly check.

- Password: Create a strong password.

- Country of Residence: Select Oman.

- Account Currency: Choose the currency you want to use.

After filling in your details, click “Continue.”

Step 4: Verify Your Email and Phone Number

Exness will send a verification link to your email. Click the link to verify. You may also need to enter a code sent to your phone.

Step 5: Provide More Personal Information

Enter your full name, date of birth, and your current address.

Step 6: Verify Your Identity

To finish setting up your account, upload:

- A copy of your ID or passport.

- A recent utility bill or bank statement to confirm your address.

Step 7: Set Up Security

For extra security, set up two-factor authentication (2FA) using an app on your phone.

Step 8: Start Trading

Once everything is set up and verified, your account is ready. You can now deposit money and start trading.

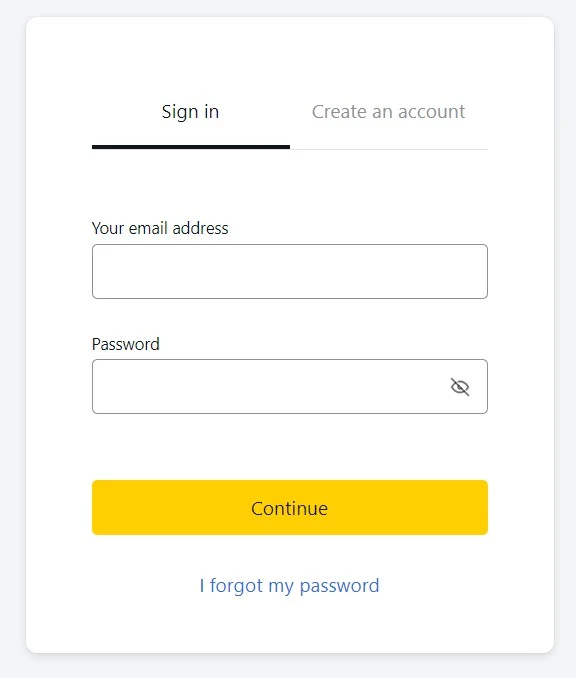

Exness Login Process for Omani Traders

Once registered, logging into your Exness account is simple. Omani traders can access their accounts via the Exness website or mobile app by entering their registered email and password. Logging into your Exness account is easy and straightforward. Here’s how you can do it:

Step 1: Visit the Exness Website or Open the App

Go to the Exness website on your computer or open the Exness mobile app on your phone.

Step 2: Click on “Sign In”

On the homepage of the website or the app, you will see a “Sign In” button. Click on it to proceed.

Step 3: Enter Your Login Details

You will be prompted to enter:

- Email Address: The email you used during registration.

- Password: The password you created for your account.

If you have set up two-factor authentication (2FA), you will also need to enter the code sent to your authentication app.

Step 4: Access Your Account

Once you’ve entered your details, click “Sign In” to access your account. You’ll be taken to your Exness dashboard, where you can manage your account, deposit funds, and start trading.

Funding Your Exness Account in Oman

Exness provides a variety of local and international payment methods for Omani traders to fund their accounts. These options are designed to be fast, secure, and convenient.

Local Deposit Methods

Omani traders can deposit funds into their Exness accounts using local payment methods such as bank transfers, along with international options like credit/debit cards, e-wallets, and cryptocurrencies. Exness ensures that all transactions are processed quickly, allowing traders to start trading without delay.

Withdrawing Funds from Exness in Oman

Withdrawing funds from your Exness account in Oman is a seamless process, with multiple options available to suit your needs.

Withdrawal Methods

Omani traders can withdraw their funds using the same methods they used for deposits, including local bank transfers, e-wallets, and cryptocurrencies. Exness guarantees that withdrawal requests are processed promptly, ensuring that you have access to your funds when you need them.

Processing Times

Exness is known for its fast withdrawal processing times. Most withdrawals are processed instantly, meaning you can access your funds within minutes. However, some methods may take up to 24 hours, depending on the provider and transaction method.

Available Trading Instruments

Exness offers Omani traders a wide range of trading instruments, including forex pairs, commodities, indices, cryptocurrencies, and more. This diversity allows traders to build a well-rounded portfolio and take advantage of various market opportunities.

Exness provides a variety of trading signals, including signals for forex, commodities, and indices. These signals are designed to cater to different trading styles and preferences, helping traders make informed decisions in diverse market conditions.

Educational Resources for Omani Traders

Exness is committed to helping Omani traders improve their trading skills through various educational resources. These include webinars, video tutorials, articles, and a comprehensive help center that covers everything from basic trading concepts to advanced strategies.

Advantages of Trading with Exness in Oman

Trading with Exness offers several advantages for Omani traders, including competitive spreads, fast execution, no hidden fees, and 24/7 customer support in Arabic. Additionally, Exness provides a secure trading environment, backed by multiple international licenses, ensuring that your funds are safe and your trading experience is reliable.

Trade with Exness – Trusted by Over 800,000 Traders

Discover why Exness is the broker of choice for over 800,000 traders and 64,000 partners. Start trading with a reliable, secure platform today.

Frequently Asked Questions about Exness Oman

Which Exness trading account is best for beginners?

For beginners in Oman, the Standard account is the best option. It requires no minimum deposit and offers user-friendly features, competitive spreads, and access to a wide range of trading instruments. This makes it ideal for those new to trading.

What local deposit methods are available to Exness clients in Oman?

Omani traders can fund their Exness accounts using local bank transfers, as well as international options like credit/debit cards, e-wallets, and cryptocurrencies. These methods are secure and offer quick processing times to ensure funds are available for trading without delay.

How does the Exness withdrawal process work for Omani traders?

Withdrawing funds from Exness in Oman is straightforward and can be done using the same methods as deposits. Most withdrawals are processed instantly, giving traders quick access to their funds. Some transactions may take up to 24 hours, depending on the payment provider.

What educational resources does Exness offer for beginner traders from Oman?

Exness offers a variety of educational resources tailored for beginner traders in Oman, including webinars, video tutorials, and articles. These resources cover everything from basic trading concepts to more advanced strategies, helping new traders build their knowledge and confidence.