Exness Islamic Account

Designed to strictly comply with the principles of Islamic finance, Exness Islamic accounts offer a pathway for traders to participate in the financial markets in accordance with Islamic law. Preferred by Muslim investors, these swap-free accounts ensure a trading environment that aligns with their faith without compromising religious principles.

Islamic Accounting Principles in Trading

Islamic finance is governed by distinct principles that set it apart from traditional financial systems, emphasizing ethical transactions and strict adherence to Islamic law. The Exness Islamic Account is designed to embody these values, incorporating an efficient and religiously compliant trading platform.

The prohibition of usury (interest):

The prohibition of riba, or interest, is one of the pillars of Islamic finance, expressing the belief that money should only make a profit through interest. Accordingly, the Exness Islamic Account eliminates interest-based transactions, including swap fees on nightclubs, in line with the principle that money should not be commoditized for profit.

The prohibition of gharar (uncertainty):

Islamic finance strictly prohibits gharar, which refers to uncertainty or ambiguity in financial transactions. This prohibition aims to ensure transparency and fairness, preventing deception or misinformation. The Exness Islamic Account adheres to this principle by offering clear and straightforward trading terms and contracts, fostering a transparent trading environment.

Prohibiting investment in illicit industries:

Investing in industries deemed haram (forbidden), such as those involving alcohol, gambling, and pig production, is prohibited under Islamic finance. The Exness Islamic account honors this law by excluding access to markets associated with these industries, demonstrating respect for the ethical and religious observance of Islamic law.

Swap-Free Trading for Islamic Countries

Exness offers swap-free accounts to users from selected Muslim countries, adhering to Islamic law by eliminating swap fees on overnight positions. This feature enables Muslim traders to participate in the financial markets in a way that does not conflict with their religious values. The swap-free option is available for all trading instruments offered by Exness, ensuring universal access to Sharia-compliant trading opportunities.

However, please note that Exness reserves the authority to withdraw swap-free status if any improper use of the feature is detected. In such cases, an administrative fee may be applied to future transactions to prevent the swap-free item from being exploited.

Countries eligible for swap-free Exness accounts include a wide range of countries in the Middle East, Africa, and Asia, facilitating access to ethical trading platforms for a large percentage of the Muslim world:

Afghanistan, Algeria, Azerbaijan, Bahrain, Brunei, Bangladesh, Bosnia and Herzegovina, Chad, Comoros, Ivory Coast, Djibouti, Egypt, Indonesia, Jordan, Kazakhstan, Kuwait, Kyrgyzstan, Lebanon, Libya, Maldives, Mali, Mauritania, Morocco, Niger, Oman, Pakistan, Palestine, Qatar, Saudi Arabia, Somalia, Senegal, Tajikistan, Tunisia, Turkey, Turkmenistan, United Arab Emirates, and Uzbekistan.

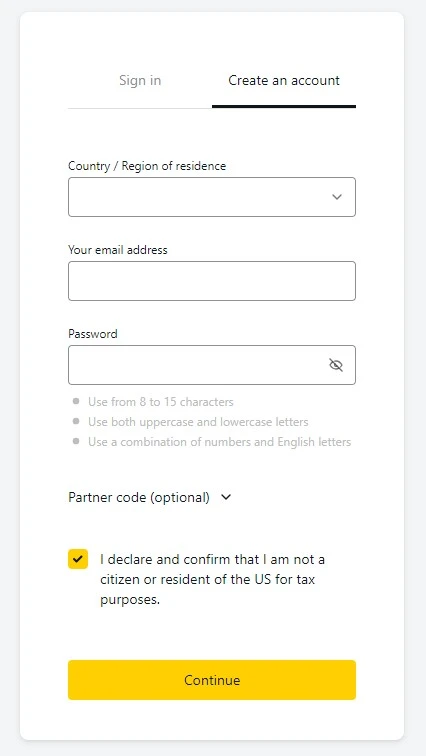

Opening an Islamic Account with Exness

The beginning of an Islamic Exness account is characterized by ease and compliance with Sharia principles.

Steps to open an Islamic Account with Exness:

- Start account creation: Go to the Exness website and choose the option to create a new account.

- Select Account Type: During registration, select your preference for an Islamic account.

- Fill out the registration form: Provide your personal and contact details accurately.

- Agree to the terms: Accept the terms and conditions, confirming adherence to the principles of Islamic finance.

- Submission of documents: Upload the necessary documents for identity and address verification.

- Wait for verification: Verification is usually completed within a few business days.

- Fund your account: Once verified, deposit funds through any available payment method.

- Start trading: Sign up for trading activities and enjoy swap-free terms.

Documents Required to Open an Account

The process of opening an Islamic account requires some documentation to verify your identity and residency. This is an essential step to maintain a safe trading environment and adhere to regulatory standards. Be ready with:

- Proof of identity: Valid passport or national ID card.

- Proof of address: A recent utility bill or bank statement.

These documents are necessary to verify your identity and residency, in line with regulatory standards to maintain a safe trading environment.

Account Verification Process

The account verification phase is crucial in determining the validity of your information and compliance with Exness’ trading guidelines. This process includes:

- Review initial documents: Checking documents for correctness and completeness.

- Detailed verification: Comparing the information provided with global compliance rules.

- Assessment: Assess financial knowledge and trading experience, as needed.

- Confirmation of eligibility: Verifying the suitability of the Islamic account based on the compliance verification.

- Verification notification: Clarification of account status and any additional requirements via email.

- Account activation: After successful verification, your Islamic account is activated, ready for swap-free trading.

Exness platforms for Islamic account users

Exness provides Islamic account users with a variety of trading platforms, compliant with Islamic finance rules and granted access to multiple markets. A brief overview:

- MetaTrader 4 (MT4): Known for its powerful analytical capabilities, Exness MT4 offers customizable trading with advanced charting, multiple technical indicators, and expert advisor support for automated strategies.

- MetaTrader 5 (MT5): An evolution of MT4, Exness MT5 is a multi-asset platform with more trading features, additional indicators, and access to stock and futures markets, ideal for traders at all levels.

- Web terminal: The Exness Web Terminal’s download-free web platform allows for no-download access, providing all trading and security functions directly via any web browser, ideal for those who prefer instant market access.

- Mobile application: The Exness mobile app, for both Android and iOS, provides comprehensive trading and account management on the go, allowing users to trade, analyze and manage accounts anytime, anywhere.

Accessing Markets through Exness Islamic Accounts

Exness provides Islamic account holders with broad access to the markets, offering a Shariah-compliant trading experience across a variety of assets:

- Forex: Participate in the vast forex market, trading a wide range of currency pairs from major to exotic.

- Metals: Invest in precious metals such as gold and silver, known for their stability and appeal as safe-haven assets.

- Stocks: Get access to global stock markets, trading shares of leading companies in various industries and exchanges.

- Commodities and indices: Explore trading opportunities in commodities, including oil, natural gas and agricultural products, and navigate through global indices that reflect market and sector trends.

- Cryptocurrencies: For those interested, Exness offers cryptocurrency trading, providing an option for digital assets that complies with Islamic accounting standards by ensuring transparent and ethical trading practices.

Benefits of Exness Islamic Account

The Exness Islamic Account is specifically designed to meet the needs of Muslim traders, adhering to the principles of Islamic finance and offering a comprehensive range of trading benefits:

- Interest-free trading: In accordance with Islamic law, this account type eliminates swap or transit fees on overnight positions to ensure interest-free trading activities.

- Hold positions for an extended period of time without fees: Traders are allowed to hold positions over an extended period without incurring transit fees, supporting long-term trading methods.

- Transparent trading conditions: Exness prioritizes a transparent trading environment, free of hidden fees or charges, ensuring fairness and clarity in all transactions.

- Access to diverse markets: Traders have access to a wide range of markets, including forex, commodities and indices, facilitating portfolio diversification while remaining compliant with Islamic finance principles.

- Dedicated support for Exness Islamic accounts: Dedicated customer support is available for Islamic account holders, providing personalized help and advice.

- Legal and regulatory compliance: Trading through an Exness Islamic account ensures operations within a legal framework compliant with international rules and legislation for security and integrity.

Final Thoughts

The Exness Islamic Account seamlessly integrates the principles of Islamic finance with the requirements of modern financial trading. It ensures that Muslim traders can participate in the financial markets without compromising their religious beliefs. By eliminating elements such as riba (interest), gharar (uncertainty), and not investing in haram industries, this account sets a new standard for ethical trading practices in the context of Islamic law. The application of transparent trading conditions and the prohibition of hidden fees underscores Exness’ commitment to fairness and integrity.

Furthermore, providing a variety of markets enables traders to broaden their investment horizons while staying true to their ethical standards. Customized support for Islamic account holders highlights Exness’ commitment to providing an inclusive, respectful and supportive trading environment. This holistic approach not only represents the ethical and legal expectations of Muslim traders, but also contributes to a fairer and more principled global trading system. In essence, the Exness Islamic Account represents a thoughtful convergence of faith-based ethics and contemporary trading needs, offering a comprehensive and reliable platform to navigate the financial markets in accordance with Islamic financial guidelines.

Frequently Asked Questions about Islamic Business Accounts

What sets Exness Islamic accounts apart from others?

Exness Islamic accounts are characterized by strict adherence to Sharia principles, comprehensive market access, and no hidden fees. In addition, dedicated support and a commitment to transparency and security make them a preferred choice for traders looking for a Sharia-compliant trading environment.

How quickly can I verify my Exness Islamic account?

The Exness Islamic account verification process is usually completed within a few business days. This is done to ensure that all necessary checks are done to maintain a safe and compliant trading environment.

Does Exness offer education on Islamic finance to traders?

Yes, Exness provides a range of educational resources and tools to help traders understand the principles of Islamic finance and how to apply them in a trading context. This includes webinars, articles and guidance from expert advisors.

How does Exness handle market speculation within Islamic accounts?

Exness respects the Islamic approach to preventing excessive speculation or gambling. As such, trading practices within Islamic accounts are designed to promote risk management and responsible trading in accordance with ethical and religious standards.

Can non-Muslim traders benefit from using an Exness Islamic account?

Absolutely. While it is designed to meet the requirements of Islamic finance, the ethical trading framework, transparency and fairness offered by the Exness Islamic Account will appeal to any trader interested in ethical trading practices, regardless of their religious beliefs.