Exness Egypt

Exness is an online trading broker serving clients in Egypt and around the world. With over 15 years of experience, Exness aims to provide Egyptian traders with competitive terms, advanced trading platforms, and excellent customer support.

Exness Company Background

Exness was founded in 2008 and is regulated in multiple jurisdictions, providing security and peace of mind to clients. Based in Cyprus, Exness adheres to strict standards set by EU financial regulators.

As an institutional broker, Exness executes more than 60,000 trades per day and supports a growing client base spread across more than 120 countries. The broker’s key areas of focus include competitive pricing, fast execution speed, multiple trading platforms, and 24/7 multilingual customer support.

| 🌐 Exness in Egypt | 📝 Details |

|---|---|

| 💰 Founded in | 2008 |

| 🏢 Headquarters | Cyprus |

| 📈 Trading Instruments | Currency pairs, stocks, indices, and CFDs |

| 🛠️ Trading Platforms | MetaTrader 4, MetaTrader 5, MetaTrader WebTerminal, and a custom WebTrader |

| 📱 Mobile Apps | Available for Android and iOS |

| 💼 Trading Accounts | Standard accounts, Professional accounts, Demo accounts, and Islamic swap-free accounts |

| 📜 Regulation | FCA, CySEC, FSCA, FSC, FSA, and FSC |

| 🌐 Languages | Multiple languages |

| 💳 Payment Methods in Egypt | Bank transfers, e-wallets, local bank transfers, Vodafone Cash |

Over the years, Exness has received numerous industry awards recognizing the quality of its trading services for clients worldwide. As a trader-friendly broker for Egypt, Exness aims to provide the best conditions tailored to local traders’ needs.

The company’s financial stability, client fund security, and transparent trading practices offer confidence to Egyptian traders in their broker. With a strong reputation and commitment to service, Exness strives to be a reliable partner for traders in Egypt.

Exness, an international brokerage firm, is expanding its presence in several countries. Here you can learn about:

Is Exness Regulated and Authorised to Operate in Egypt?

When choosing a broker, it is important for Egyptian traders to consider regulation and licensing. Exness maintains transparency and adheres to strict standards, providing peace of mind for clients.

Exness is regulated by the Cyprus Securities and Exchange Commission (CySEC) under licence number 178/12. CySEC applies rules in line with European MiFID standards, ensuring that brokerage firms implement appropriate compliance measures. For Egyptian traders, Exness also holds an international licence from the FCA (UK). Although Exness is not directly regulated in Egypt, it accepts clients from this country and complies with all applicable rules and regulations. The broker’s website and platforms provide specialised support for Egyptian traders by providing Arabic translations and local payment methods such as bank transfers and e-wallets.

Exness transparently discloses its regulatory status on its website. Traders can check official licence numbers to make sure the broker is operating legally.

Trading Platforms offered by Exness

Exness provides traders with platform options to suit different preferences:

- Exness MetaTrader 4 (MT4) is the most popular trading platform. Easy to use with advanced charting tools, indicators, and automated trading robots. MT4 can be accessed on desktop, web browser, iOS or Android.

- Exness MetaTrader 5 (MT5) is the latest version of the platform with more features. It supports stocks, futures, cryptocurrencies as well as more order types and timeframes. It can be accessed via devices such as MT4.

- Exness Web Terminal is a browser-based platform for basic trading functions. Trading currency pairs, metals, indices, and cryptocurrencies with live quotes and charts. Easy access from any device.

- The Exness Trader App offers mobile access for Android and iOS. Allows trading with over 300 instruments on the go. The app offers quotes, charts, news and account management with a modern and customisable interface.

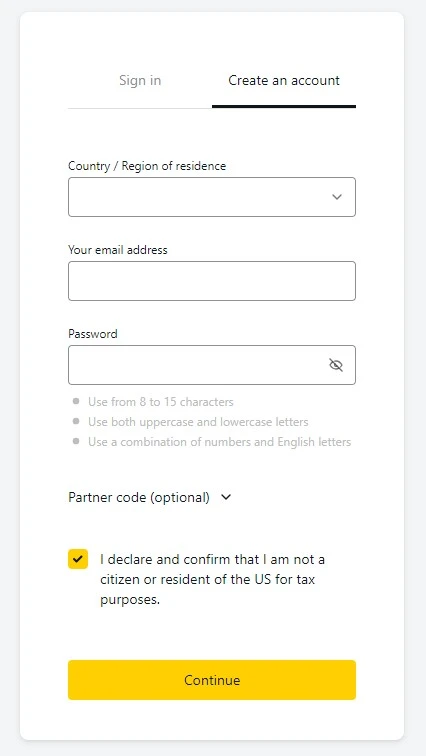

Opening an account with Exness in Egypt

To start trading with Exness in Egypt, you need to follow these steps:

- Complete a quick online registration with your personal/contact information and password. Receive an account activation email.

- Choose an account type (Standard, Professional, Zero, Islamic) based on features such as minimum deposit, spreads, leverage.

- Identity verification by uploading passport, national ID or similar documents.

- Funding the new account through Egyptian payment methods such as bank transfers, e-wallets, cash payment services. The minimum amount depends on the account type.

- Start trading on MT4, MT5, Web Terminal or the mobile app with over 300 markets available. Copy trading services can also be used.

Minimum Deposit and Account Types

- Standard Account has a minimum deposit of $1 and unlimited leverage. Variable spreads from 0.3 pips. Best for new traders.

- Regular Cent account allows micro trades for deposits as small as one dollar. Test strategies while minimising risk.

- Professional account requires a minimum deposit of $200. Leverage up to 1:2000, tight spreads from 0.1 pips. More advanced features.

- Zero account with a minimum deposit of $200. Zero spreads plus commissions as low as $3.5 per lot. Access to advanced platforms.

Each account balances features such as deposit requirements, leverage amounts, spread model, commission structure and platform availability. Traders can match an account with their capital level, risk appetite and experience.

Funding and Withdrawal Options

- Bank cards such as Visa and MasterCard allow deposits from $3 and withdrawals from $6. Fast processing but bank fees may apply.

- Major e-wallets such as Skrill and Neteller are available. Minimum deposit of $10, withdrawal of $4. Usually instant processing.

- Leading cryptocurrencies supported including Bitcoin, Ethereum, Litecoin. Minimum deposit $10, withdrawal $20. Up to 24 hours processing.

- Local payment services such as Fawry, Aman and Masari available. Very low deposit/withdrawal limits of $1-3. Instant or next day processing.

By supporting global payment processors as well as convenient local options, Exness aims to provide seamless funding and withdrawals for customers in Egypt. Traders can choose methods in line with their preferences, fee tolerance and processing speed needs.

Exness Islamic Account for Egyptian Traders

Exness offers a Sharia-compliant Islamic account for Muslim traders. Also known as an exchange-free account, this account does not include overnight interest or exchange fees that are considered haram in Islam. Instead, Islamic accounts include a transparent commission fee based on contracts held overnight. The commission depends on the account type, the asset traded, and the lot size.

An Islamic account offers the same trading features and benefits as regular Exness accounts. This includes competitive spreads, high levels of leverage, access to advanced platforms such as MT4/MT5, and copy trading services. Traders can analyse markets, implement strategies, and manage their funds without compromise.

Opening an Islamic account follows the same standard Exness registration process. However, clients must then contact Client Support to request that they formally request exchange-free status for their trading accounts. The Exness team activates the Islamic status within 24 hours in most cases. This provides a Shariah-compliant trading environment that is designed to align with Islamic values.

Exness trading conditions in Egypt

Exness aims to provide transparent and competitive trading conditions for clients in Egypt. This includes spreads as low as 0.1 pips, leverage as high as 1:2000, over 250 tradable assets, advanced trading platforms and no withdrawal fees.

Exness Spreads, Commissions and Fees in Egypt

Exness charges variable spreads and commissions depending on the account type and trading instrument. Spreads start from 0.3 pips for Standard and Cent accounts, and from 0 pips for Raw, Zero, and Professional CFD accounts. Commissions range from $0 to $3.5 per contract, depending on account type and instrument. Exness does not charge any fees for deposits or withdrawals, but some payment providers may apply fees. Exness also does not charge any inactivity fees, unless the account has been inactive for more than six months.

Exness Leverage Levels

Exness offers different levels of leverage depending on account type, instrument, and equity value. The maximum leverage available is 1:unlimited, which means that the margin requirement is zero for most instruments. However, this option is only available for Standard and Standard Cent accounts with an equity value of less than $1,000. Other accounts have a maximum leverage of 1:2000, which is still quite high compared to other brokers. Leverage levels also vary depending on the instrument, with lower leverage for more volatile assets.

Supported Markets and Assets

Exness supports a wide range of markets and assets for its clients in Egypt, including over 300 instruments across different categories. Exness clients can trade currency pairs, metals, indices, cryptocurrencies, and stocks, as well as access Exness’ social trading service to copy the trades of other successful traders. Exness offers various trading platforms to meet the needs and preferences of its clients, such as MetaTrader 4, MetaTrader 5, Exness Web Terminal, and Exness Trader App. Exness also offers an interest-free Islamic account option for traders who follow the Islamic faith and wish to trade in accordance with Sharia principles.

Exness Copy Trading Options

Copy trading is a feature that allows you to automatically copy the trades of other successful traders on the Exness platform. This way, you can benefit from their experience, skills, and strategies, without having to spend a lot of time and effort analysing the market and making decisions. Copy trading is ideal for beginners who want to learn from the best, as well as for busy or lazy traders who want to save time and energy.

To start copy trading with Exness, follow these steps:

- Download the Exness Social Trading app, available for Android and iOS devices.

- Create an account and log in to the app.

- Browse and select a strategy that suits you. A strategy is another trader’s trading account that you can follow and copy. You can evaluate each strategy’s performance, risk level, and profitability, and choose strategies that match your goals and preferences. You can also view the profile, portfolio, and history of each strategy provider, and communicate with them via chat.

- To copy a strategy, click ‘Start Copying’ and enter the amount you wish to invest. You can also set a maximum loss limit, which will stop copying if your losses reach a certain percentage of your investment. You can start copying with as little as $10, and you can copy up to 20 strategies at the same time. You can also stop copying at any time, and withdraw your funds whenever you want.

- Pay a commission fee to the strategy provider for each winning trade you copy. The commission fee is deducted from your account balance at the end of each trading day and varies by strategy provider and instrument. You can see the commission fees for each strategy before you start copying, and you can also view the commission history in your personal area.

Exness Educational Resources for Egyptian Traders

Exness provides Egyptian traders with various cross-platform educational materials to enhance trading skills:

- Help Centre – comprehensive FAQs and tutorials covering account types, payments, tools and platform navigation. Contact support directly for assistance.

- Trading Blog – up-to-date articles and posts detailing the latest market news, events, tips and strategies. Improve analytical capabilities and performance.

- YouTube Channel – Video tutorials and webinars that explain Exness platforms, tools and features in depth. Includes trader interviews and testimonials.

- Social Trading App – Enables copy trading with access to community forums. Exchange ideas and feedback with retail and professional traders within the app.

Whether you’re just starting out or want to take your skills to the next level, Exness Instruction offers something for everyone. Through multi-format resources from written manuals to videos as well as community discussions, traders can guide their learning. This helps in gaining new trading perspectives, risk management techniques, analytical methods as well as controlling emotions. Comprehensive materials are available 24/7.

Ready to get started?

It takes just 3 minutes to set up your account and get it ready for trading.

Advantages of Choosing Exness for Trading in Egypt

Exness is a reliable and reputable broker that offers many benefits and features to its clients in Egypt, such as:

- Competitive trading fees: Exness charges low spreads and commissions, depending on the account type and instrument. Exness does not charge any fees for deposits or withdrawals, but some payment providers may apply fees.

- Diverse trading instruments: Exness supports over 300 market instruments, including currency pairs, metals, indices, cryptocurrencies, and stocks. Exness also offers access to the Exness Social Trading Service, where traders can copy the trades of other successful traders.

- User-friendly trading platforms: Exness offers a variety of trading platforms to suit the needs and preferences of its clients, such as MetaTrader 4, MetaTrader 5, Exness Web Terminal, and Exness Trader App. Exness also offers an interest-free Islamic account option for traders who follow the Islamic faith and wish to trade in accordance with Sharia principles.

- Strong regulation: Exness is regulated by several reputable financial regulators, such as the FCA, CySEC, and ASIC, which helps ensure a safe trading environment. Exness also complies with the requirements of the local regulatory body in Egypt.

Is Exness a good choice for traders in Egypt?

Exness is a good choice for traders in Egypt, offering a reliable and trustworthy trading experience, competitive pricing, diverse asset selection, and user-friendly trading platforms. Exness also respects the Islamic religion and values and offers an interest-free account option for its clients in Egypt. Exness has an extensive network of offices around the world and multilingual technical support. Exness also provides various educational resources, such as webinars, tutorials, and articles, to help traders improve their skills and knowledge.

Frequently Asked Questions

Here are some frequently asked questions and answers about Exness for traders in Egypt:

Does Exness offer interest-free Islamic trading accounts in Egypt?

Yes, Exness offers Islamic accounts for both regular and professional account types. You can request an interest-free status from our customer support team.

What are the deposit and withdrawal methods offered by Exness in Egypt?

Exness offers various payment options, such as bank cards, e-wallets, cryptocurrencies, and local payment methods. Minimum deposit and withdrawal limits, processing times, and fees vary depending on the option you use.

What documents do I need to open an Exness account in Egypt?

You need to provide proof of identity, such as a passport or ID card, and proof of address, such as a utility bill or bank statement. The documents must be clear and valid.

Can I get help from Exness Customer Support in Egypt if I need it?

Yes, you can contact the Exness customer support team via live chat, email, phone, or social media. The support team is available 24/7 and speaks multiple languages.

Is the Exness mobile app available to customers in Egypt?

Yes, you can download the Exness mobile app for free from the Google Play or App Store. The app allows you to trade, deposit, withdraw, and access Exness' social trading service.