Exness Account Types

Exness has different accounts for traders such as Standard and Professional. Each requires a different amount of money to start trading, has different fees and allows you to use different leverage. Choosing the right account is key!

Standard accounts are suitable for beginners. They are affordable and allow you to get used to the market. Professional accounts are for experienced traders who want tighter spreads and lower fees. There is also a demo account for practice and an Islamic account that complies with Islamic law. Before you start trading at Exness, carefully examine each type to find the right one for you!

Exness Standard Account

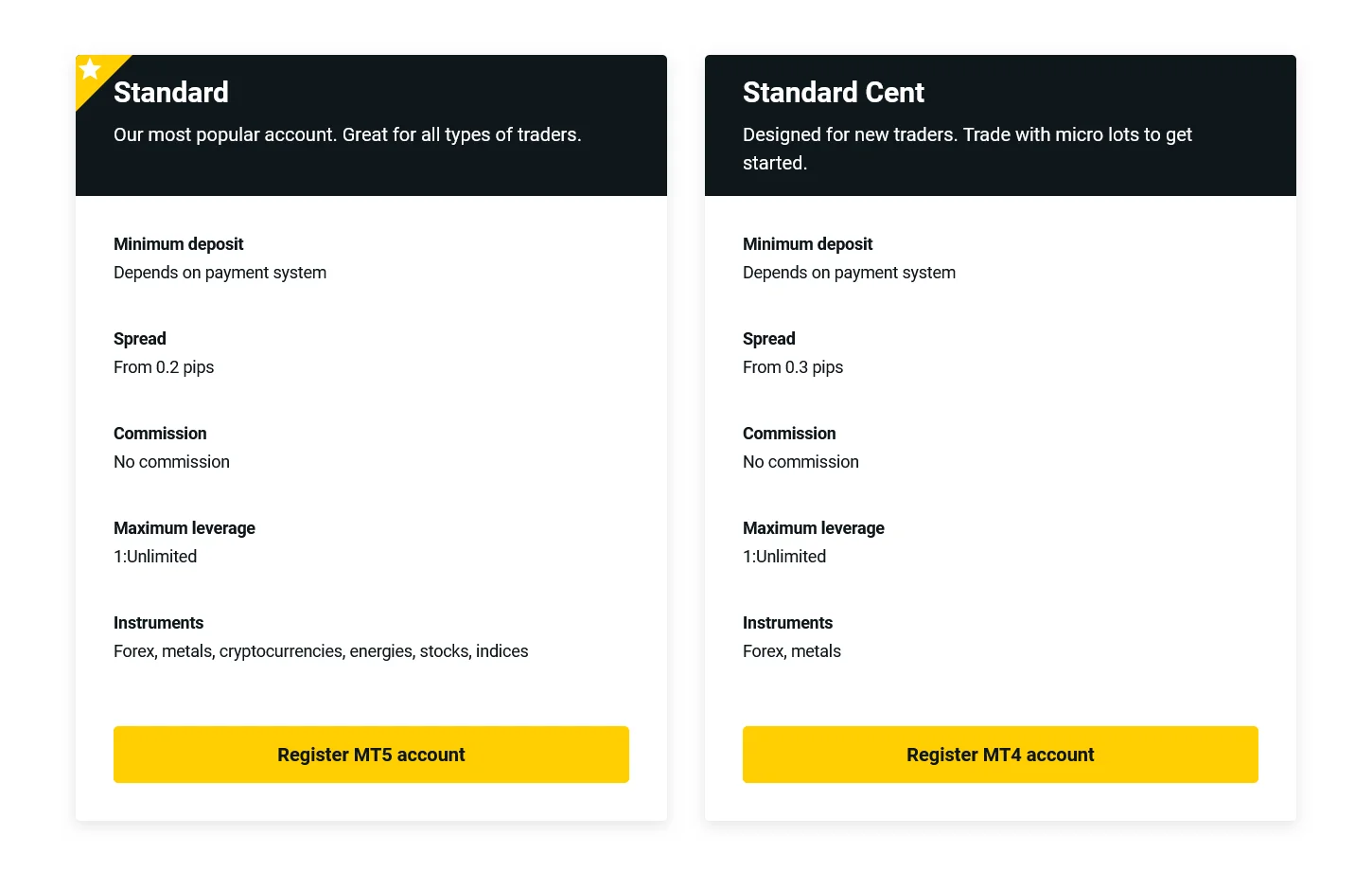

Exness offers two types of standard calculations: Standard Account and Standard Cent Account.

Standard accounts are ideal for traders at all levels, offering simplicity and affordability. They have great minimum deposit requirements for beginners, fixed spreads for major currency pairs and metals, and leverage up to 1:2000, depending on the assets.

With fixed spreads and standard leverage, Standard Accounts are simple and suitable for a variety of trading strategies. Whether you’re a beginner learning the basics or an experienced trader looking for a reliable daily account, Exness Standard Accounts provide you with a solid foundation for trading across a range of markets.

- Standard Account

- Standard Cent Account

Standard Account

The standard Exness account is very popular among traders because of its flexibility. This type of account is suitable for both beginners and professional traders.

For starters, a standard account offers attractive benefits: Relatively tight fixed spreads and Exness’ relatively low minimum deposit. This makes it easy to learn the basics of forex trading without putting significant capital at risk.

In addition, this trading account offers ample opportunities for professional traders. It covers major currency pairs, metals, oil, and indices, allowing you to apply different trading strategies for short and long-term goals.

| Account type | Standard |

| Minimum Deposit | Starts from 1 USD (depends on the payment system) |

| Leverage | Up to 1: Unlimited |

| Available tools | Forex, metals, cryptocurrencies, energy, stocks and indices |

| Commissions | none |

| Spreads | Starts at 0.2 pips |

| Hedge margin | 0% |

| Lowest Volume | 0.01 |

| Maximum positions | unlimited |

| Calling the margin | 60٪ |

| Execution of orders | Market-based |

| No usury | Available |

The Exness Standard Account deserves its popularity among traders of different experience levels due to the harmonious combination of simplicity, reliability, and advanced features.

Exness Standard Cent Account

The Standard Cent trading account is designed specifically for newcomers, providing easy entry into the Exness platform. It enables forex trading with cent lots.

| Account type | Standard Cent |

| Minimum Deposit | Starts from 1 USD (depends on payment system) |

| Leverage | Up to 1: Unlimited |

| Available Instruments | Forex & Metals |

| Commission | None |

| Spread | Starts from 0.2 pips |

| Hedging Margin | 0٪ |

| Minimum Trading Volume | 0.01 |

| Maximum Positions | 1000 |

| Margin Call | 60٪ |

| Order Execution | On Market |

| Without Interest | Available |

The main advantage of a standard cent account is its flexibility in managing trading volume and risk through smaller lot sizes. This makes it an ideal choice for beginners or those who want to experiment with trading strategies while keeping risks to a minimum.

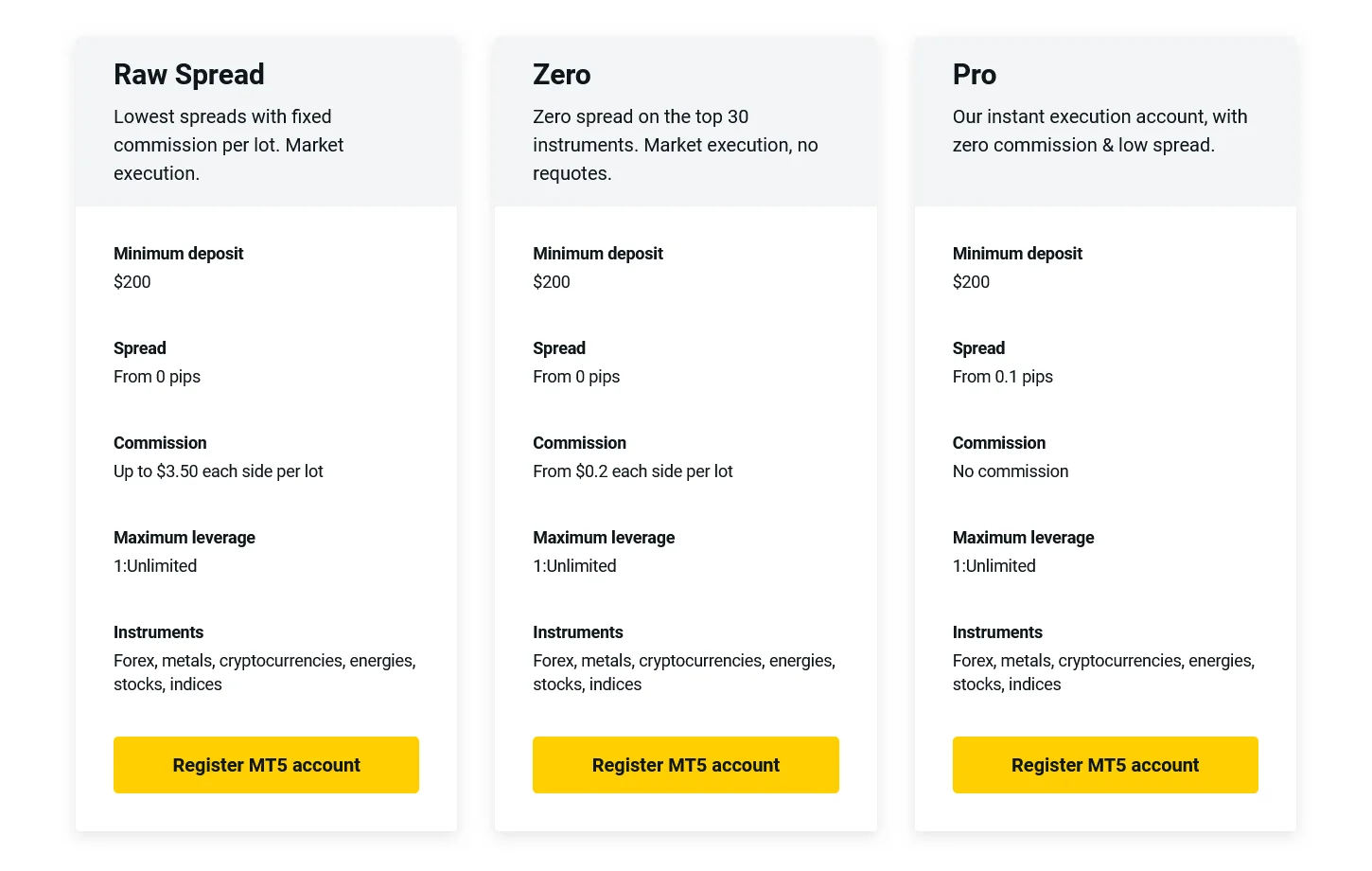

Exness Professional Accounts

Exness Professional accounts are designed for experienced traders looking for advanced features and ideal conditions for active trading in the financial markets. This category includes Raw, Zero and Professional spread accounts, each of which has a number of advantages over Standard accounts.

It is worth noting that professional accounts offer variable and usually reduced spreads, which proves its special value for traders involved in large transaction volumes. In addition, they offer higher leverage, up to 1:3000. Moreover, these accounts give the opportunity to engage in trading forex sub-pairs and stocks.

- Raw Spread Account

- Zero Account

- Pro Account

Raw Spread Exness Account

This account is for experienced traders who want the best Forex trading conditions. The main advantage of the Raw Spread account is the lowest possible spread, which starts from 0 pips.

| Account type | Raw Spread |

| Minimum Deposit | $200 |

| Leverage | Up to 1: Unlimited |

| Available instruments | Forex and various contracts on stocks, metals and raw materials |

| Commission | $3.5 per lot |

| Spread | 0 pips |

| Hedging margin | 0٪ |

| Minimum trading volume | 0.01 |

| Maximum positions | Unlimited |

| Margin call | 30٪ |

| Order execution | No requotes, according to the market |

| No interest | available |

The Raw Spread account is ideal for spot delivery methods and trading competition participants, as it will provide them with the best possible cost-effectiveness for trades.

Exness Zero Account

Zero account for active Forex trading with no spreads on 30 leading trading instruments. It is intended for skilled traders.

Another advantage of this account is that Exness only requires $200 to start trading, while other platforms require deposits of thousands of dollars. Because of this benefit, it is not surprising that traders often choose Exness as they can get the full trading experience in the Zero account without paying a lot of money.

| Account type | Zero |

| Minimum Deposit | $200 |

| Leverage | 1: Unlimited |

| Available instruments | Forex, Gold, Silver, Oil, Indices |

| Commission | From $0.2 per side per lot |

| Spread | 0 pips |

| Hedging margin | 0٪ |

| Minimum trading volume | 0.01 |

| Maximum positions | Unlimited |

| Margin call | 30٪ |

| Order execution | On Market |

| No interest | Available |

The Zero account is different from other ECN accounts. It is ideal for getting the most accurate prices and fast liquidity when trading.

Exness Pro Account

This account is for experienced traders and investors with a lot of trading experience. This is because the Pro account has a variable floating spread that can be as low as 0 pips depending on market liquidity. This allows you to get the most effective trade prices. Also, the available leverage of 1:3000 provides greater opportunities for profit compared to Standard accounts.

With this type of trading account, you can trade millions of dollars without paying any commission to the platform.

| Account type | Professional |

| Minimum Deposit | $200 |

| Leverage | 1: Unlimited |

| Available instruments | Forex, CFDs, Futures, Bonds, Stocks |

| Commission | No Commission |

| Spread | 0 pips |

| Hedging margin | 0٪ |

| Minimum trading volume | 0.01 |

| Maximum positions | Unlimited |

| Margin call | 30٪ |

| Order execution | On Market |

| No interest | Available |

Another advantage of the Pro account is a personal manager who will provide professional assistance and tailor trading accounts to the specific trader’s needs for maximum efficiency. Also, special Pro trading signals from Exness experts are provided. Therefore, for careful traders who want the most adaptable and professional trading conditions in the financial markets, the Exness Pro account is the best choice.

How to Choose the Best Exness Account for You

Exness has different types of real trading accounts to suit different traders’ needs and preferences. Each account has its own advantages and trading conditions. Here are some factors to consider when choosing an account.

Spread type and size

Spread is the difference between the bid and ask prices of a trading instrument. A fixed spread remains the same regardless of market conditions, while a floating spread changes based on market liquidity. A tighter spread means lower trading costs. Standard and Cent Standard accounts have a fixed spread, while Zero, Pro and Raw Spread accounts have a floating spread. Raw and Zero Spread accounts have the tightest spreads – from 0 pips when the market is liquid. Standard and Cent Standard accounts have a fixed standard spread. Pro accounts have a variable spread that can be very high or low.

Leverage

Leverage is the ratio of the trader’s own funds to the funds borrowed from the broker. Higher leverage means higher potential profits, but also higher risks. Standard and Cent Standard accounts have a leverage of 1:2000, while Pro, Zero and Raw Spread accounts have a leverage of 1:3000.

Available tools

An instrument is a financial asset that can be traded, such as Forex, CFDs, Futures, Bonds and Stocks. Pro accounts have the largest number of instruments to choose from, while Standard accounts only have major currencies and metals.An instrument is a financial asset that can be traded, such as Forex, CFDs, Futures, Bonds and Stocks. Pro accounts have the largest number of instruments to choose from, while Standard accounts only have major currencies and metals.

Minimum Deposit

The minimum deposit is the amount required to open an account. Standard and Cent Standard accounts have a low minimum deposit of $1, while Pro, Zero and Raw Spread accounts have a higher minimum deposit of $200.

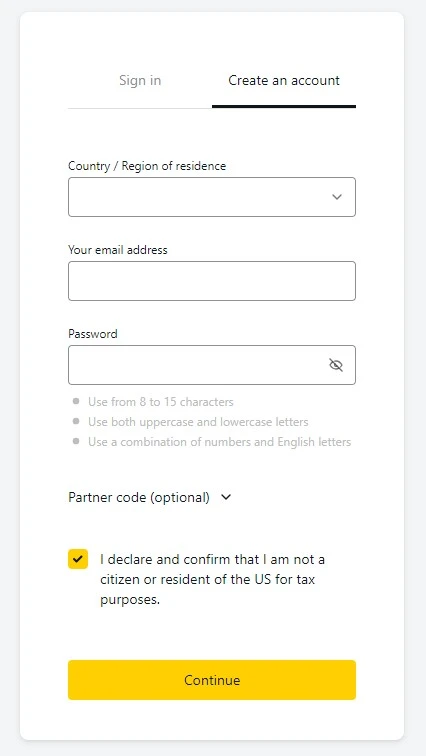

Start trading with Exness

Exness is a convenient broker for trading in the financial markets. You can open an account and start trading in a short time by following these steps:

- Register on the Exness website and choose a real account type. We recommend starting with a standard account with a minimum deposit of $1.

- Deposit funds through more than 15 payment systems. Funds will be credited instantly.

- Install and configure the Exness MetaTrader 4 or Exness MetaTrader 5 platforms to facilitate trading. For direct and efficient access to the markets, use the Exness WebTerminal, a powerful platform designed to facilitate trading without the need for installations.

- Study the market and choose a currency pair or asset to trade. Make your first demo trade and close it.

After that, you are ready to start trading with a real account! If you are planning to open an account with Exness, check out the Exness login pages and Exness registration pages.

Exness Demo Account

An Exness demo account is a great opportunity for beginners to learn trading without losing money or taking risks. After a quick registration on the broker’s website, clients receive $10,000 in virtual funds in their demo account, taking full advantage of the MetaTrader 4 and 5 platforms. Visit the Exness demo account page for more information.

A demo account is intended for any type of live trading account. It can be used to place trades, try out trading methods and platforms, and learn the necessary skills.

You can also use your demo account on Exness mobile applications. Exness provides you with everything you need to improve your trading skills without risk, which will help you avoid making common mistakes of beginners in real trading.

Islamic account

Exness has special Islamic accounts for Muslim traders who follow the rules of Islamic finance. There are no swaps, as Islam does not allow earning money from interest on loans.

Islamic accounts only charge small conversion fees when depositing or withdrawing funds on Exness. It is possible to benefit from a leverage of 1:1000. Otherwise, they are the same as regular Exness accounts and are available in Standard and Pro versions.

This account was created to meet the religious needs of Muslims in Forex trading. This is a good way for them to earn money from trades.

It is essential to complete the Exness verification process after selecting your account type. This step is essential to ensure the security of your trading activities and compliance with regulatory requirements. The verification process helps protect your account and ensures a smoother experience with withdrawals and deposits.

Exness is widely recognized as a very popular broker globally and has a significant presence in Arab countries, including:

Exness account types: Frequently asked questions

How much do I need to deposit to open a standard cent account with Exness?

All you need is just $1 to open a standard cent account. This allows you to trade in penny lots with very little money.

What are the differences between the Exness Standard and Professional accounts?

The main difference is in the type of spreads (fixed or floating), commissions, minimum deposit, leverage, and the instruments you can trade.

Does Exness have a demo account?

Yes, Exness provides you with a free demo account with 10,000 USD of fake money to practice risk-free.

Can I have an Islamic account with Exness?

Yes, there are standard and professional Islamic accounts for Muslim clients, which have no swaps or interest charges.